FBI Investigation: Scam Artists Use Forged Deed and Counterfeit ID’s to Steal Concord, MA Property; Local Real Estate Agent, Developer, and Attorneys Caught Up In Fraudulent Transaction

Using a counterfeit driver’s license and passport (shown at right), fake e-mail address impersonating the real owner, and a forged deed and notary stamp, scam artists were somehow able to dupe a local real estate agent and two seemingly experienced real estate attorneys, and get to the closing table, where a Concord, MA lot was fraudulently sold to a local developer, and the scammers getting away with nearly $500,000 in stolen sale proceeds. The transaction had red-flags all over the place, yet all the purported professionals seemed to have buried their head in the sand and ignored the clear warnings of fraud, according to a lawsuit recently filed by my office on behalf of the victims. With a looming FBI financial crimes investigation and active federal grand jury proceeding in Boston, my clients are seeking to restore their title and ownership and recover damages for this title theft scam.

Title Theft: A Brief History

With the proliferation of publicly searchable land records, internet search capabilities, and reliance on electronic communications, “title theft” has become an increasingly prevalent criminal scheme to transfer properties from unsuspecting owners and steal millions of dollars. Property owners across the country have been targeted by scammers who prepare deeds purporting to convey title to property the scammers do not own. Sometimes, the true owners are entirely unaware of these bogus transfers. In other instances, the scammers use misrepresentation to induce unsophisticated owners to sign documents they do not understand.

Massachusetts is no stranger to the wave of title theft schemes. In 2018, convicted felon Allen Seymour and accomplices orchestrated a complex scheme using forged documents, bogus notary stamps, and fake driver’s licenses to defraud several innocent home owners, buyers and lenders in connection with fraudulent sales of properties in Cambridge, Brookline and Somerville, resulting in over $1.5 Million in losses. I represented several victims in those cases which were successfully prosecuted by the Attorney General’s Office, with Seymour sentenced to 6-8 years in prison.

Scam Artists Target A Vacant Lot in Mattison Farms Subdivision in Concord

My clients are an older married couple now living in South Carolina. Back in 1991, they purchased a 1.8 acre lot in the Mattison Farms subdivision in Concord. They originally intended to build a home on the lot, however, the husband’s practice as a cardiologist took the family out of state for several decades. The couple kept the property and paid the real estate taxes all along, hoping at some point maybe they would move back to Massachusetts or gift the lot to one of their three adult sons so they could someday build a home here. The lot is now likely worth north of $1 Million.

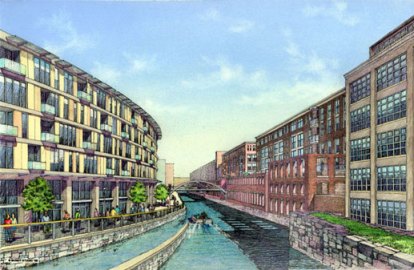

At some point in 2023, using a fake email account, the scam artist contacted a local real estate agent, and convinced him that she was the true owner of the Concord lot and interested in selling it. Successful, the broker placed the Property on the Multiple Listing Service with a list price of $699,900, advertising that it was “a great opportunity to build your dream home in the ultra-exclusive, sought after and prestigious Mattison Farm neighborhood. One of the only remaining lots and nestled on a 1.84 acre parcel. Close proximity to Concord & Nashawtuc Country Club.” The broker quickly found an interested buyer in a local real estate agent and developer who had his sights set on building a new luxury home on the Property. Using a fake electronic signature, the imposter signed an offer and purchase and sale agreement with the buyer, agreeing to sell the lot for $525,000 – hundreds of thousand of dollars less than the fair market value of the lot.

Red Flags: Counterfeit South Carolina Driver’s License, U.S. Passport, an Apartment in Dallas, Texas

One of the keys to this successful scam was that the scam artist provided the players involved with a copy of a fake South Carolina driver’s license and US Passport (shown above). However, both identifications display tell-tale signs of counterfeit. The driver’s license and passport both use the same photograph – which is impossible because the state registry of motor vehicles and U.S. Passport Office work off independent systems. The driver’s license layout is clearly fake when compared to a real South Carolina ID, and there’s no evidence of a hologram.

Even more suspicious, despite the ID’s showing a South Carolina residential address, the scam artist suspiciously instructed the seller attorney to send the deed and power of attorney to a nondescript apartment in Dallas, Texas. And when those “signed” documents came back to the seller attorney there were other tell-tale signs of forgery and fraud. Critical portions of the notary clause were left blank; the county of notarization is misspelled as “Tourrant,” instead of Tarrant County, Texas; the notary’s signature is clearly bogus; and the notary stamp was lifted from other documents and transposed using a PDF editing program.

Town Permits and Access

With the real owners blissfully unaware and the professionals apparently not picking up on the fraud, the transaction proceeded forward with the buyer applying for various town approvals for construction. Using a fake digital signature, the scam artist signed various applications for those approvals, which were submitted by the buyer to the Town of Concord. The real owners got a certified letter about the town approvals, and immediately contacted the Concord Natural Resource Director who informed them that the Property was “up for sale.” My client told the director that they absolutely did not list the Property for sale and had no knowledge of any pending sale, and sent her an email demanding that all proceedings be terminated. After that, according to our lawsuit, the director informed the buyer team of my client’s call, however, nothing was done to investigate the potential fraud and stop the approval process. Shockingly, the Town approved the permits without any further inquiry.

Despite All The Red Flags for Forgery and Fraud, the Closing Goes Forward

As of late March into April 2024 – months prior to the scheduled closing – all parties and their attorneys knew or should have known of the existence of irregularities, fraud and/or forgery in this transaction, according to our lawsuit. Yet, none of them put the transaction on pause in order to further investigate whether in fact the transaction involved forgery or fraud, as would be reasonable to do in the circumstances. Despite all of the visible red flags, notice of the true owner’s claim of ownership and likely forgery, the closing of the transaction went forward on May 13, 2024, with the seller attorney executing the closing documents pursuant to the forged power of attorney.

The final and perhaps most telling red flag came at the very end of the closing process with the scam artist instructing the attorneys to send the nearly $500,000 seller proceeds check to a UPS Store address in Philadelphia, PA. So at this juncture we have a South Carolina address on the driver’s license and passport, a Dallas, Texas apartment address for the deed and power of attorney delivery, and UPS storefront in Philly for the proceeds check. As the saying goes, “make it make sense.”

The scam artist received the check, deposited it into a Charles Schwab account, and the money is now gone, along with the title to my client’s property.

To make matters far worse, there is now a $1.8 Million construction loan mortgage on my client’s title, and the “buyer” is well into site work and construction on the Property. The land has been cleared and graded with numerous trees cut down, a foundation poured and a large house framed out, portions of the septic system installed, and utility service brought in, as shown above.

The Aftermath: FBI Investigation And Superior Court Lawsuit

When my client ultimately discovered that their property had been officially sold and that a house was being built on the land, she started shaking and screaming, and then fainted, spending the next days and weeks riddled with anxiety and nightmares. My clients then went to the FBI, Concord Police and the Middlesex District Attorney’s Office to report the matter. The FBI Financial Crimes Squad in Boston is conducting an active investigation of this matter, and FBI agents have already interviewed the two attorneys involved in the transaction who are cooperating. Grand jury subpoenas have also been issued. The scam artists have not been found as of yet.

On September 11, 2024, we filed the lawsuit below for quiet title, trespass, civil conspiracy, and negligence against the buyers, the developer and the attorneys involved in the transaction. My clients are hopeful that they can restore their ownership to their property and get some measure of compensation for this ordeal, which should have never happened. I will keep you posted as to developments. This story is a painful warning to all real estate professionals to be on the look out for title theft scammers from out of state who target vacant properties or unsophisticated owners. And needless to say, always purchase owner’s title insurance when you buy any real estate! There are also “Title Lock” services which claim to monitor your title and ownership but I cannot vouch for them at all.

The CBS 4 Boston I-Team recently did a segment on the case, below.

Verified Complaint Halla Shami v. Geesey, Middlesex Superior Court (Mass.) CA 2481CV02412 by Richard Vetstein on Scribd

{ 3 comments }

A little break from law stuff to talk about some important safety information. With up to a foot of snow on most Massachusetts roofs and a spring thaw on the way, there will be widespread ice dam and roof damage afflicting homeowners in the next weeks. I have a feeling it’s going to be very bad.

A little break from law stuff to talk about some important safety information. With up to a foot of snow on most Massachusetts roofs and a spring thaw on the way, there will be widespread ice dam and roof damage afflicting homeowners in the next weeks. I have a feeling it’s going to be very bad.

then refinish.

then refinish.