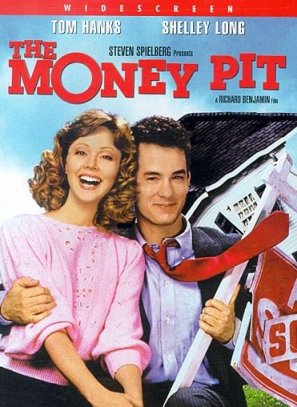

With the economy and housing market on the upswing, builders are finally building again. I’ve seen a definite uptick in new construction purchases. Buying a new construction home, however, is very different and much more involved compared to buying a previously owned property. In this post, I want to cover the various aspects of purchasing a new construction home, from selecting a builder, financing, legal, through construction and to the closing. As the Beatles song goes, I also have a little help from my Realtor friends in this post who have graciously offered some of their expert guidance. Follow our advice, and hopefully you will avoid becoming Tom Hanks and Shelley Long in the hilarious movie, The Money Pit!

With the economy and housing market on the upswing, builders are finally building again. I’ve seen a definite uptick in new construction purchases. Buying a new construction home, however, is very different and much more involved compared to buying a previously owned property. In this post, I want to cover the various aspects of purchasing a new construction home, from selecting a builder, financing, legal, through construction and to the closing. As the Beatles song goes, I also have a little help from my Realtor friends in this post who have graciously offered some of their expert guidance. Follow our advice, and hopefully you will avoid becoming Tom Hanks and Shelley Long in the hilarious movie, The Money Pit!

Selecting and Working with a Builder

Choosing the right builder is obviously critical. You can search for builder licenses and state disciplinary history at the Mass.gov site here. (Search under Construction Supervisor). If the builder is not a licensed Construction Supervisor, they may be licensed as a Home Improvement Contractor (HIC) which can be searched at the Office of Consumer Affairs website here. If they hold neither license type, that’s a red flag. Also, look up the builder’s name in the Mass. Land Records site, and check whether they have any mechanic’s liens filed against them. That is another red flag indicating they may be undercapitalized and don’t pay their subcontractors.

Get a list of the last 5 homes the builder has constructed, and try to talk to those homeowners. Don’t rely on the builder’s list of references as no intelligent builder would give out a bad reference.

Hire A Buyer’s Agent

Besides conducting a town-wide survey, one of the smartest things you can do is hire an independent buyer’s real estate agent, preferably one with lots of experience in new construction. While buyers today can do a lot of their own due diligence and research on prospective builders, an experienced Realtor knows all the local builders in town and knows who builds castles and who builds shanty-shacks. A buyer’s agent will also provide a much-needed buffer between the builder’s sales agents and listing agent, many of whom unfortunately engage in high-pressure sales tactics and fast-talking. As buyer agent, Marilyn Messenger advises,

“Many buyers don’t realize that if they visit a new construction site without a buyer agent, they run the risk of having to work directly with the builder’s agent whose job is to work in the best interest of the builder. A buyer’s agent will watch out for the buyer’s interests.”

Amenities, Allowances & Upgrades

The builder should provide you with a detailed specification sheet with a standard panel of features and options for flooring, appliances, paint, trims, HVAC, and lighting, etc. These will be built into the purchase price. Most builders also have allowances for things like additional recessed lighting, upgraded stainless steel appliances, decking, and fancy hardwood floors. As Cambridge area Realtor Lara Gordon notes, the buyers’ ability to select design elements is one of the major advantages of new construction.

It’s imperative that all allowances be spelled out in writing and attached to the purchase contract documents, which I will discuss later. Change orders are common during the construction process, and these too should be memorialized in writing. They will be added to the purchase price or paid in advance.

New construction purchases in Massachusetts follow the same basic legal process as already-owned homes. The parties first execute an Offer to Purchase which spells out the very basics of the transaction: down payment and purchase price, closing date, and financing contingency. A lot of builders ask for more than the standard 5% deposit, but I would push back on that in this market.

After the offer is signed, the parties will sign the Purchase and Sale Agreement. As a buyer, the detailed specifications, amenities and agreed upon allowances must be incorporated into the contract, along with the floor and elevation plans, if any.

The proposed purchase and sale agreement will likely track the so-called “standard form,” but the builder will typically add a detailed rider, which is completely different than the usual seller rider seen in existing home contracts. The builder rider will have provisions dealing with how change orders are handled, that the builder is not responsible for cracking due to climatic changes, and may attempt to hold the buyer’s feet to the fire with respect to getting his financing in place. A lot of builders will try to limit the availability of holdbacks at closing. I would push back on this important item of leverage for buyers. Some of the large national builders such as Pulte will even claim that their contracts are “non-negotiable.” This is nonsense. Everything is negotiable these days.

Hiring an experienced real estate attorney will tip the balance back to the buyer, and the attorney should have a comprehensive buyer rider in place to protect you in case there are title issues or you suddenly lose your financing. Because there are often delays with new construction, one of the most important rider provisions for buyers is a clause which will give buyer’s protection in case they lose their rate lock due to a delay.

Mortgage Financing

Most new construction buyers in Massachusetts will take out a conventional mortgage loan, with the builder responsible for financing the actual construction through his own construction loan. Some builders, especially national ones, will have their own mortgage lending for their projects, but they often don’t offer the best rates and terms. Sometimes, buyers will finance the construction through a construction loan under which the borrower pays interest only through the construction process, and is then converted to a conventional mortgage once the home is completed. I would counsel buyers to avoid taking on the financial responsibility of a construction loan. As with all lending, shop around and compare apples to apples.

Inspections & Warranties

For new construction, home inspections must necessarily be delayed from the usual timeframe (7-10 days after accepted offer) where the home is not yet completed, and buyers should absolutely reserve their right to perform the usual comprehensive home inspection prior to closing. (If the home is already done, get in there with the home inspector). During the construction phase, builders don’t want buyers on the construction site, for obvious liability (and annoyance) reasons, so resist the urge to buy your own hard-hat and hang out with the construction guys. Metrowest area agent Heidi Zizza of mdm Realty retells a funny story about a Natick woman who literally broke a window trying to gain entry into her under-construction home.

Contrary to popular belief, Massachusetts law does not require a 1-year builder’s written warranty for new construction, however, most builders will provide one, albeit littered with exceptions to coverage. Fairly recent Massachusetts case law does impose a 3 year “implied warranty of habitability” for certain undiscovered construction defects. Again, selecting a reputable builder in the first place is “the ounce of prevention worth the pound of cure.”

Contrary to popular belief, Massachusetts law does not require a 1-year builder’s written warranty for new construction, however, most builders will provide one, albeit littered with exceptions to coverage. Fairly recent Massachusetts case law does impose a 3 year “implied warranty of habitability” for certain undiscovered construction defects. Again, selecting a reputable builder in the first place is “the ounce of prevention worth the pound of cure.”

Punch-Lists and Closing

There will inevitably be unfinished items right up to the closing. I’ve rarely seen a new construction transaction without a punch-list at closing. Some unfinished items will be serious enough to warrant an escrow holdback at closing (remember, I had said push back on this during P&S negotiations). Some lenders, however, will not allow a holdback, so the parties will have to negotiate and be creative at closing to ensure that all unfinished work is completed within a reasonable time after closing. If the home is part of a larger project/subdivision, this is usually not an issue. However, for “one-off” single site projects, getting the builder to come back and finish punch-list items after closing can be like pulling teeth. Again, having a real estate lawyer on your side and in control of the funds will give you leverage here.

Once papers are passed, the closing attorney will lastly ensure that there are no outstanding subcontractor liens on the property, which is one of most common hiccup at closings. For this reason and many others, it is imperative that buyers obtain their own owner’s title insurance policy, to ensure that title is clear, marketable and free of undiscovered defects and liens.

Buying new construction is often a long, drawn out, and stressful process for new buyers. Do your research. Be patient. And hire the best professionals on your side. Good luck!

________________________________________________

Richard D. Vetstein, Esq. is an experienced Massachusetts real estate attorney who often handles Massachusetts new construction home purchases. If you need assistance with a new construction purchase or sale, please contact him at 508-620-5352 or at [email protected].

Richard D. Vetstein, Esq. is an experienced Massachusetts real estate attorney who often handles Massachusetts new construction home purchases. If you need assistance with a new construction purchase or sale, please contact him at 508-620-5352 or at [email protected].