BREAKING NEWS Update (Oct. 1, 2025): Stephen Webster Indicted and Arrested On Embezzlement and Larceny Charges

Owner Stephen Webster Accused Of Pilfering Over $1 Million In Escrow and Firm Funds

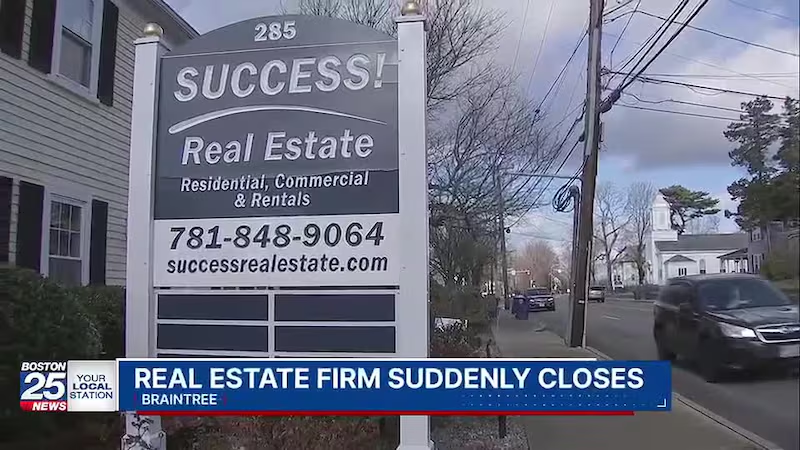

As you may have seen on Boston 25 News or read in the papers, Success Real Estate, Inc., a 140 agent real estate firm based on the South Shore, suddenly closed on December 14, 2024, surrounded by allegations that its owner, Stephen Webster embezzled over $1 Million in escrow deposits, broker commissions, and personal loans from agents. Since then, Success and Webster have been sued by over 15 agents and buyers who are scrambling to recover hundreds of thousands in unpaid commissions, deposits on pending transactions, and even personal loans given by agents to Webster in an attempt to keep the firm afloat. One of these lawsuits (embedded below) is one that I filed in Norfolk Superior Court on behalf of a top agent, where the judge granted real estate attachments against Webster and Success’ properties and assets. The Success Real Estate debacle has renewed focus on lax state regulation of broker escrow deposit accounts.

Perfect Storm of Personal Greed, Market Downturn, and Financial Mismanagement

Perfect Storm of Personal Greed, Market Downturn, and Financial Mismanagement

The Success Real Estate debacle appears to have been caused by a deadly combination of financial mismanagement, the turndown in the real estate market, and the extravagant lifestyle and personal greed by Webster. The writing was on the wall when over the last year, Webster could not obtain traditional financing and was left to ask for over $300,000 in personal loans from the very agents whom he supervises. As alleged in the lawsuits, Webster fraudulently procured these loans by falsely representing to each lending party that he had the financial ability to repay the loan in full and that it would benefit them, as agents of Success. In actuality, Webster obtained these loans no different than a “Ponzi” scheme as he was simultaneously embezzling over $1 Million from Success’ coffers in order to fund business operations and jetting between Boston and his $10,000/month Florida home on the intercoastal, as claimed in the litigation. The Attorney General’s Office is now conducting an active and ongoing investigation into the matter, and I will not be surprised if and when Webster is charged with a slew of felonies.

Renewed Focus on State Oversight of Broker Escrow Accounts

One of the worst parts of this debacle is that Webster allegedly pilfered his firm’s escrow account which holds the earnest deposit funds of buyers on pending transactions. Rumors are swirling that the exposure is well over $1 Million in the escrow account alone. This is arguably the worst thing a broker could ever do because these down payment deposits are often the life savings of innocent families. So this begs the question: Where was the state Board of Registration of Real Estate Brokers and Salespersons which has oversight over broker escrow accounts? The Board is supposed to conduct periodic audits of broker escrow accounts, but based on discussions I’ve had with people with knowledge of the Board’s operations, these audits are nothing more than a 10 minute check-in and do not examine the account inflows and outflows and bank records which could spot irregularities. When was Webster’s last audit and what did it show, if anything? Furthermore, the state required bond for escrow accounts that brokers must obtain only covers $5,000 in losses, which is insane. One can easily conclude that the inadequate state oversight of Success contributed to this debacle. State legislators and regulators should take a hard look at the Board of Registration audit operations and bond amount in order to prevent something like this from happening again.

I’m sure there will be many more claims filed against Success and Webster in the near future. I will keep readers updated with any developments. If you have any information you would like to share or if you are a victim of Success and Webster and want to file a claim, please contact me at [email protected].